Long service leave (LSL) is an undervalued employee benefit and can often be a large liability on your financial statements. However, it is possible to educate employees; more accurately value the liability and strategically manage LSL to get the best value from the cost of providing it.

Source: Australian Bureau of Statistics, August 2013

Importance of appropriately valuing LSL

Companies must determine a value to disclose in their financial statements of LSL obligations. The employee benefit accounting standard AASB 119 requires the calculation of the liability to be based on an actuarial valuation method with assumptions regarding:

- discount rates

- salary inflation

- rates of leaving service

- rates of employees taking their LSL whilst in service.

It also requires inclusion of on-costs like:

- superannuation for leave taken in service

- payroll tax

- workers’ compensation costs.

If a simplified method is used companies could be substantially over or underestimating this liability.

Importance of LSL to your employees

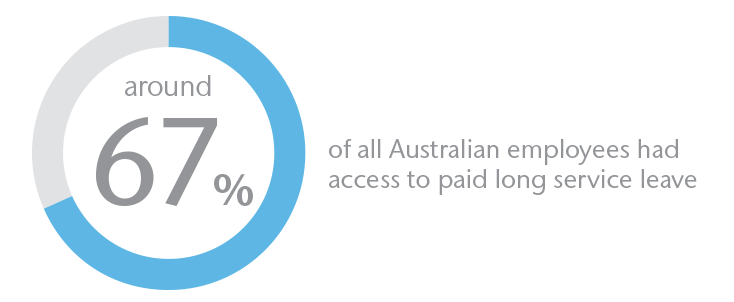

LSL is a statutory employee benefit provided to loyal, long-serving permanent (and often casual) employees in Australia. As it is compulsory, many companies do not communicate the value or have it appreciated by their staff.

With employees effectively receiving close to a week's additional holiday for every year they work for a company (which is payable after 10 years' service – though this differs by state), LSL should be a powerful retention tool. After all, workers who are well into their tenure won't want to reset the clock to zero when they'll be rewarded for staying with the organisation. Unfortunately, it is a benefit that many employees are unaware of, or undervalue as companies do very little to promote it.

Our approach

Accurate valuation

We have a team of experienced actuaries who can perform the actuarial valuation to determine a more accurate value of a company’s LSL liability to place in their financial accounts. In addition, we can assist companies in analysing actual experience to determine if that matches the assumptions used.

This will help them to understand employee behaviour around taking LSL in service and rates of leaving service at different tenure and determine whether HR policies could be changed in future based on that knowledge.

Companies are required to set aside money in their financial statements to pay staff their LSL entitlements. Putting a more accurate value on LSL as a financial liability should be a business priority. Our actuaries are able to perform projections to determine when the LSL entitlements are likely to be taken and bring these liabilities back to a present day value.

We can also assist companies in setting the assumptions based on past experience and considering current policies regarding leave and the current workforce. Our experience has shown that analysing past experience can provide finance and human resource teams a greater understanding of the effects of:

- Changes to salary

- Policies around leave

- Additional costs associated with restructures (as the eligibility criteria for LSL to be paid out for a redundancy is different to an employee choosing to leave).

Employee communication

We are experienced in conducting employee sessions to communicate employee benefits and what it means to them. This not only educates them in an aspect of their package that they may know little about, but allows companies to acknowledge this additional benefit for long-serving staff.

The value of LSL to employees can be improved by including relevant information in new employee packs, and by including information in communications such as regular staff updates, employee benefit sessions and annual performance reviews.